The global food industry is striving to balance multiple priorities. It’s grappling with how to provide nutritious food while conserving resources—and meeting evolving consumer demands.

Changes in the food sector impact farmers, traders, manufacturers, retailers and the public sector. Their cooperation, innovation and convergence increase—and bring new opportunities. Our recent research indicates that by 2035, the 'How we feed' domain could achieve a baseline gross value added of US$9.88 trillion. There’s also a potential to reach US$10.35 trillion in the best-case scenario.

Central and Eastern Europe is no exception. This shift offers huge opportunities for our market—but is the food industry ready to seize them? What do they need to know about customers to do that?

The CEE edition of our Global Voice of the Consumer Survey unpacks current food buyer habits while looking to a future of food that’s health-focused and tech-driven.

“Consumers in CEE are price-conscious yet discerning. They are concerned about cost of living, geopolitics and food safety, but unwavering in their demand for quality and sustainability. This presents a significant opportunity for the food industry to innovate. By delivering healthier, local, convenient and environmentally friendly options, companies can meet the needs of increasingly selective and tech-savvy customers in CEE.”

Mieczysław Gonta, PwC Partner, CEE and Poland Consumer Markets LeaderLearn more about consumer preferences and food industry trends in CEE in the full report

Shifting consumer dynamics: Price, security and health

We’re seeing a complex interplay of financial constraints, health aspirations and a keen eye for value. This is redefining how people shop, eat and think about food.

Consumers in CEE are feeling financial pressure more than their global counterparts. They’re concerned about the cost of living, economic instability and geopolitical conflict. Around half of food shoppers in CEE rank these issues among their top three concerns. What sets CEE apart from the global averages is heightened awareness of geopolitical risks (44% vs 27%).

These factors affect buying behaviour and mindset, so food companies must respond. Consumers in CEE aren’t just looking for low prices. They’re seeking real value in every purchase without compromising on quality. This is evident in how buyers in CEE approach grocery shopping. The first thing they consider is price (64%), but taste remains a crucial consideration (56%).

Q: When you're choosing which food items to buy, which factors are most important to you? (Ranked in top three)

For the food industry, successful strategies should focus on affordable food that maintains high taste and nutritional standards. They should also prioritise resilient local sourcing to ease geopolitical concerns.

Evolving consumer demands: Tasty, healthy and local

In the CEE food market consumers seek better value—which makes them open to brand switching. Half of shoppers in CEE are equally motivated by better value for money and taste when changing brands. Also, more than a third could be encouraged to try alternative brands by promotional offers.

Many consumers’ expectations in CEE are rooted in health considerations. People want to know what’s in their food and how it’s made to avoid health risks. As many as 65% are highly concerned about the risks of ultra-processed foods—slightly higher than the 64% worried about food costs. Other top concerns are the use of additives, preservatives and pesticides.

Prioritising freshness and seasonality are in line with health trend. Nearly half of consumers in CEE typically prefer fresh ingredients and in-season foods in their typical food habits. Preferences for local production are also clear. Buyers are twice as likely to choose local products over non-local ones (30% vs 15%). This again shows sustainability and supporting local economies are part of everyday routines in our region. Consumers understand their personal responsibility for nutrition. However, 53% believe food producers hold primary responsibility to encourage healthy and nutritious eating. Shoppers in CEE expect big food/beverage companies to provide more products that meet specific health requirements or contain fewer calories. Customers also want companies to inform them more about health and nutrition.

Q: In your opinion, how could big food/beverage companies contribute to improving the health and wellness of consumers?

Lifestyle: A growing health and convenience outlook

Customers in CEE are increasingly focused on health-driven food choices. A clear majority (87%) are somewhat reducing their alcohol consumption when making health-related dietary decisions. As many as 37% consistently avoid ultra-processed foods, while over one-third have increased their intake of alternative meats.

Convenience is also a growing trend. Consumers in CEE show a taste for prepared foods. At least once a week, 25% eat ready meals and 16% order takeaways. While customers in CEE dine out less frequently than global averages, their restaurant visits are comparable to Western European habits.

Q: On average, how often do you do the following?

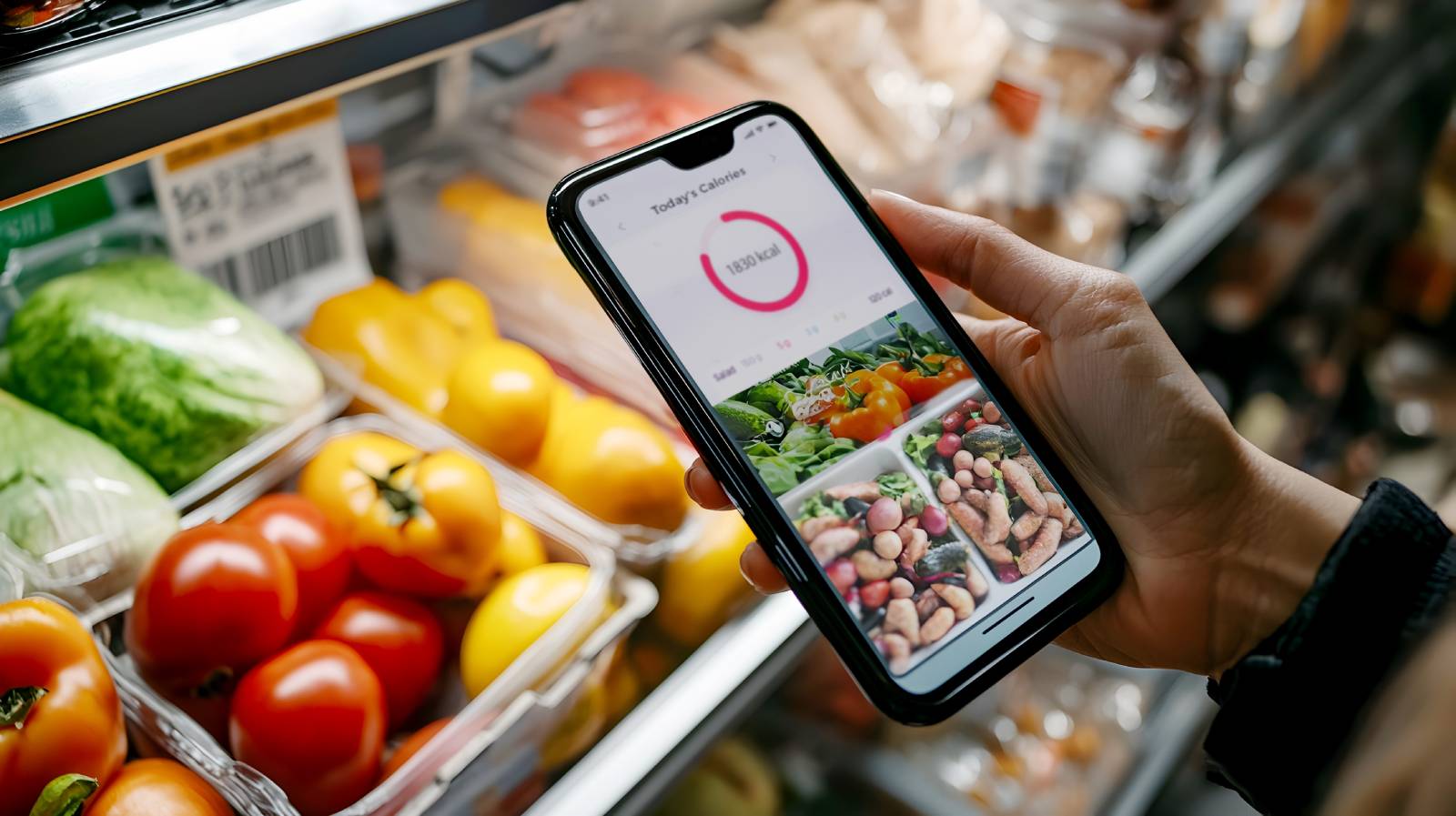

One more important lifestyle shift is that health technology is being increasingly embraced. A substantial majority of consumers in CEE utilise some form of health app or wearable technology. This showcases comfort with health management and diet-related digital tools.

For the food industry, there’s a tangible opportunity to prioritise health offerings, such as minimally processed foods. Expanding convenience foods that align with health-conscious priorities may also appeal. Another solution to support customers’ usage of health-focused technology may be leveraging digital solutions to support meal planning and dietary management.

Sustainability: In focus for food shoppers

A clear majority of 79% of consumers are to some extent worried about climate change. While environmental concerns are still evidently on the minds of customers in the region, it’s also seen in purchasing behaviour.

Many customers in CEE are open to spending extra for sustainability. As many as 35% say they will pay more for food to support the likes of improving soil quality and enhancing biodiversity. Additionally, 53% say they could be persuaded to do the same.

Sustainable behaviour is rooted in daily habits. To reduce their impact on climate change, many consumers in CEE buy only what they need, reduce personal food waste and try to eat what’s in season.

Q: Have you taken any of the following actions to reduce your impact on climate change with the food that you buy and eat? (This question was asked only to those who said climate change worries them)

Reasons for choosing local food extend far beyond environmental concerns. Consumers in CEE see health benefits, perceive better quality and want to support local producers, retailers and the economy. Almost half are willing to pay a premium for local products over cheaper imports.

It’s crucial for the food industry to think locally and understand which sustainable practices are most important for consumers. Many people in CEE prefer pesticide-free foods (52%), locally produced items (46%) and environmentally friendly packaging (34%) in this context.

Learn more about consumer preferences and food industry trends in CEE in the full report

About the Survey

In January and February 2025, PwC surveyed 21,075 consumers across 28 countries and territories: Australia, Brazil, Canada, China, Egypt, France, Germany, Hong Kong, SAR, Hungary, India, Indonesia, Ireland, Malaysia, Mexico, the Netherlands, the Philippines, Poland, Qatar, Romania, Saudi Arabia, Singapore, South Africa, Spain, Thailand, the United Arab Emirates, Ukraine, the United States and Vietnam. The respondents were at least 18 years old and were asked about a range of topics relating to consumer food consumption and trends, including grocery shopping and food choices, the future of health, emerging technology, and climate and sustainability issues.

PwC Research, PwC’s global centre of excellence for market research and insight, conducted this survey.

Contact us

Olena Volkova

Partner, Consumer Markets Industry Leader, PwC in Ukraine

Tel: +380 44 354 0404